Nebraska Income Tax Rate 2024

Nebraska Income Tax Rate 2024. Your average tax rate is 10.94%. Reduces the top individual and business income tax rates to 3.99% by tax year 2027;

On may 31, 2023, nebraska governor jim pillen signed lb. Nebraska’s 2024 income tax ranges from 2.46% to 6.64%.

Your Average Tax Rate Is 10.94%.

The nebraska department of revenue is issuing a new nebraska circular en for 2024.

Your Average Tax Rate Is 10.94%.

This new proposal is a departure from the current.

How Much The Average Person 65 And Older Spends Monthly Only 10.

Images References :

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Ranking Of State Tax Rates INCOBEMAN, Nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. 2023 individual income tax booklet, with forms, tables, instructions, and additional information.

Source: perlaqsybille.pages.dev

Source: perlaqsybille.pages.dev

Taxes By State 2024 Dani Michaelina, Both missouri and nebraska have decided to stop taxing social security benefits in 2024. Your average tax rate is 10.94%.

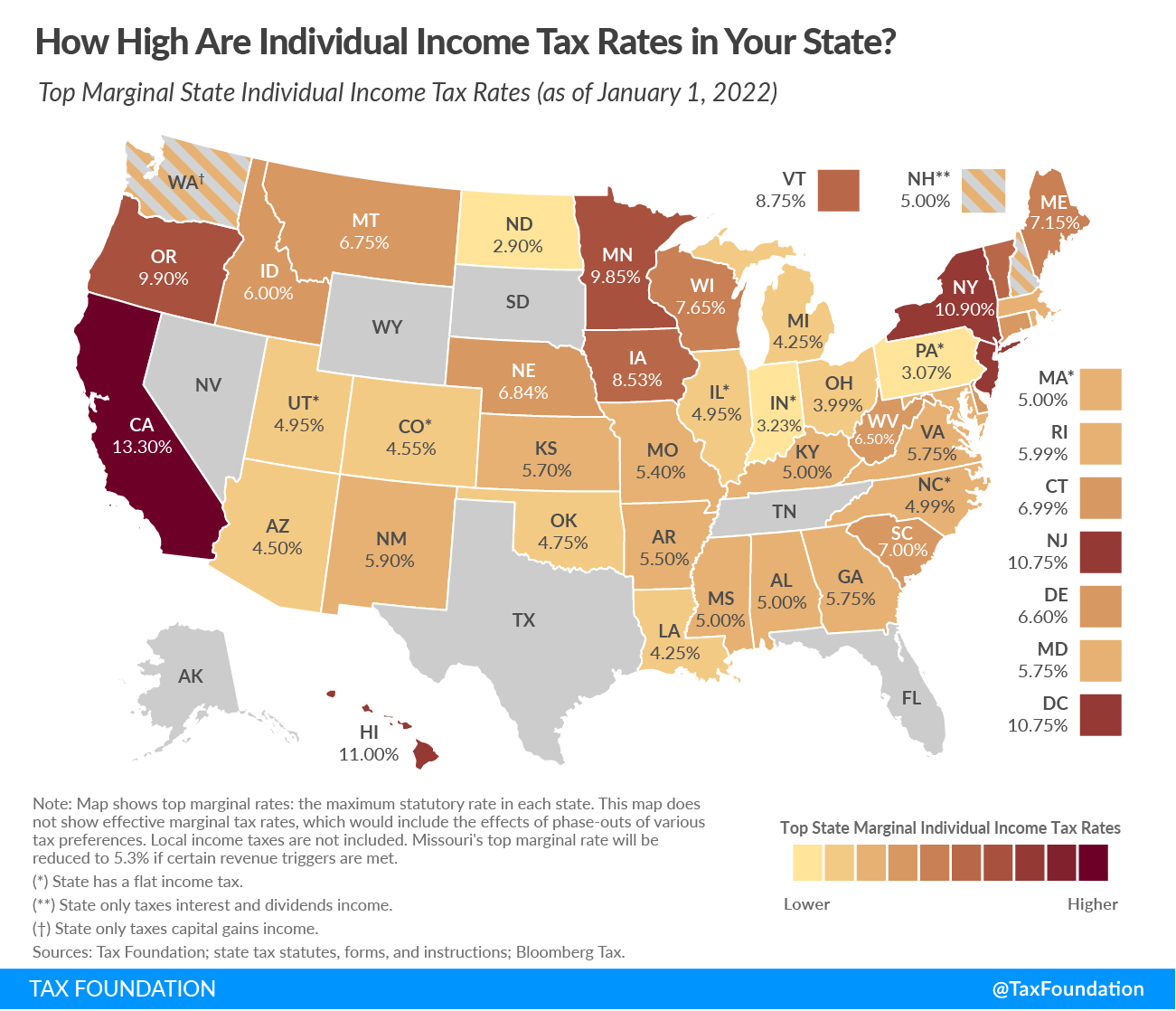

Source: www.chrisbanescu.com

Source: www.chrisbanescu.com

Top State Tax Rates for All 50 States Chris Banescu, Both missouri and nebraska have decided to stop taxing social security benefits in 2024. Nebraska's 2024 income tax ranges from 2.46% to 6.64%.

Source: www.templateroller.com

Source: www.templateroller.com

Form 1040NES 2023 Fill Out, Sign Online and Download Fillable PDF, How are capital gains taxed? How much the average person 65 and older spends monthly only 10.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Reduces the top individual and business income tax rates to 3.99% by tax year 2027; (the federal tax deadline, on.

Source: www.tax-brackets.org

Source: www.tax-brackets.org

Nebraska Tax Brackets 2024, Nebraska capital gains tax 2024 explained. Find a savings or cd account that works for you.

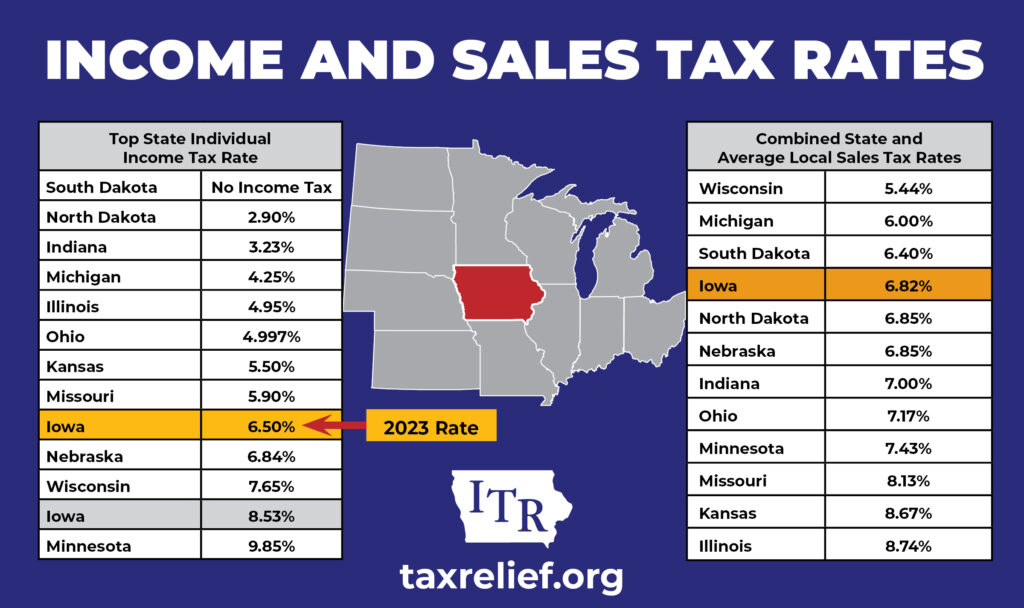

Source: taxrelief.org

Source: taxrelief.org

Midwest State and Sales Tax Rates Iowans for Tax Relief, Income tax tables and other tax information is sourced from the nebraska. Nebraska state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents.

Source: www.forbes.com

Source: www.forbes.com

The Best States to Start a Business in 2024 Forbes Advisor, Nebraska capital gains tax 2024 explained. Collections in fiscal year 2022,.

Source: hbecpa.com

Source: hbecpa.com

Nebraska Introduces PTET Law and Lowers Tax Rates HBE, Collections in fiscal year 2022,. What are the types of capital gains?

Source: ellynnqannalise.pages.dev

Source: ellynnqannalise.pages.dev

What Are The Different Tax Brackets 2024 Eddi Nellie, Refer to the following table to view. Nebraska capital gains tax 2024 explained.

Refer To The Following Table To View.

Nebraska's 2024 income tax ranges from 2.46% to 6.64%.

When Income Taxes Are Due Varies Among The States That Collect Them.

Nebraska residents state income tax tables for married (separate) filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold;